Working Papers

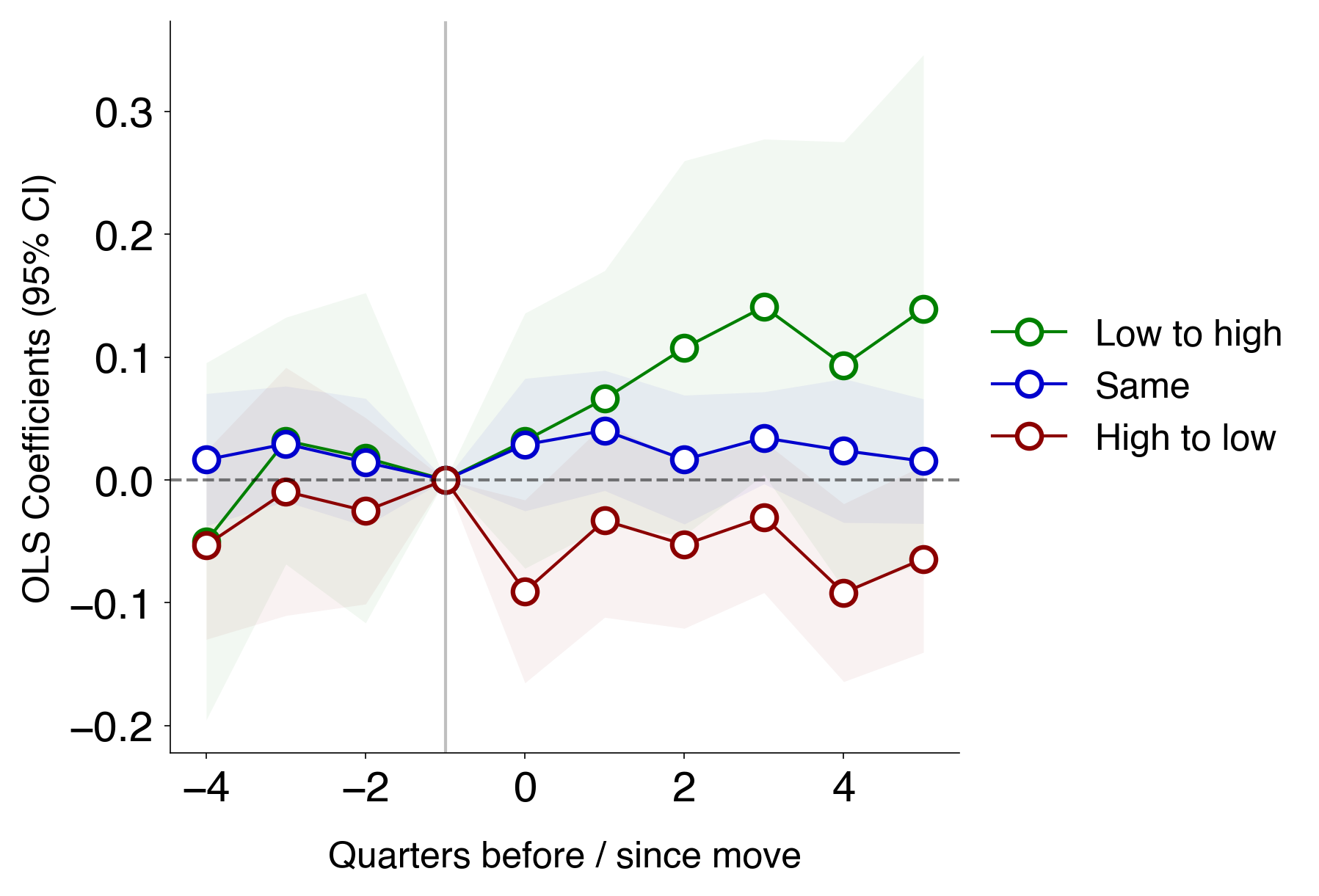

Movers adjust social capital according to their destination neighborhood.

Who Visits the University Village? Lessons on Gentrification and Social Capital from Twitter

There is little consensus on why amenity investments may lead to greater displacement in some neighborhoods more than others. This paper provides new evidence on proximity to social capital as a determinant of neighborhood type. Using ten years of geo-tagged Twitter data in Los Angeles, I construct granular measures of residential mobility and social capital, including collective action, class solidarity, partisan division, and hate speech. I find that neighborhood social capital is strongly correlated with changes in residential mobility after significant amenity investments. Moreover, a user's social capital increases in their duration of residence and is not predicted by their demographic profile. I apply these measures to rationalize changes in regional mobility after the University of Southern California's $700 million redevelopment of its University Village. Difference-in-differences estimates show that visits to public and residential amenities in neighboring tracts decrease by 87% relative to propensity-matched tracts with similar census characteristics pre-construction. Visits to consumer amenities increase by 4-folds. Control function estimates indicate that declines in social capital of one's neighbors explain more than 55% of the variation in mobility among incumbent residents.

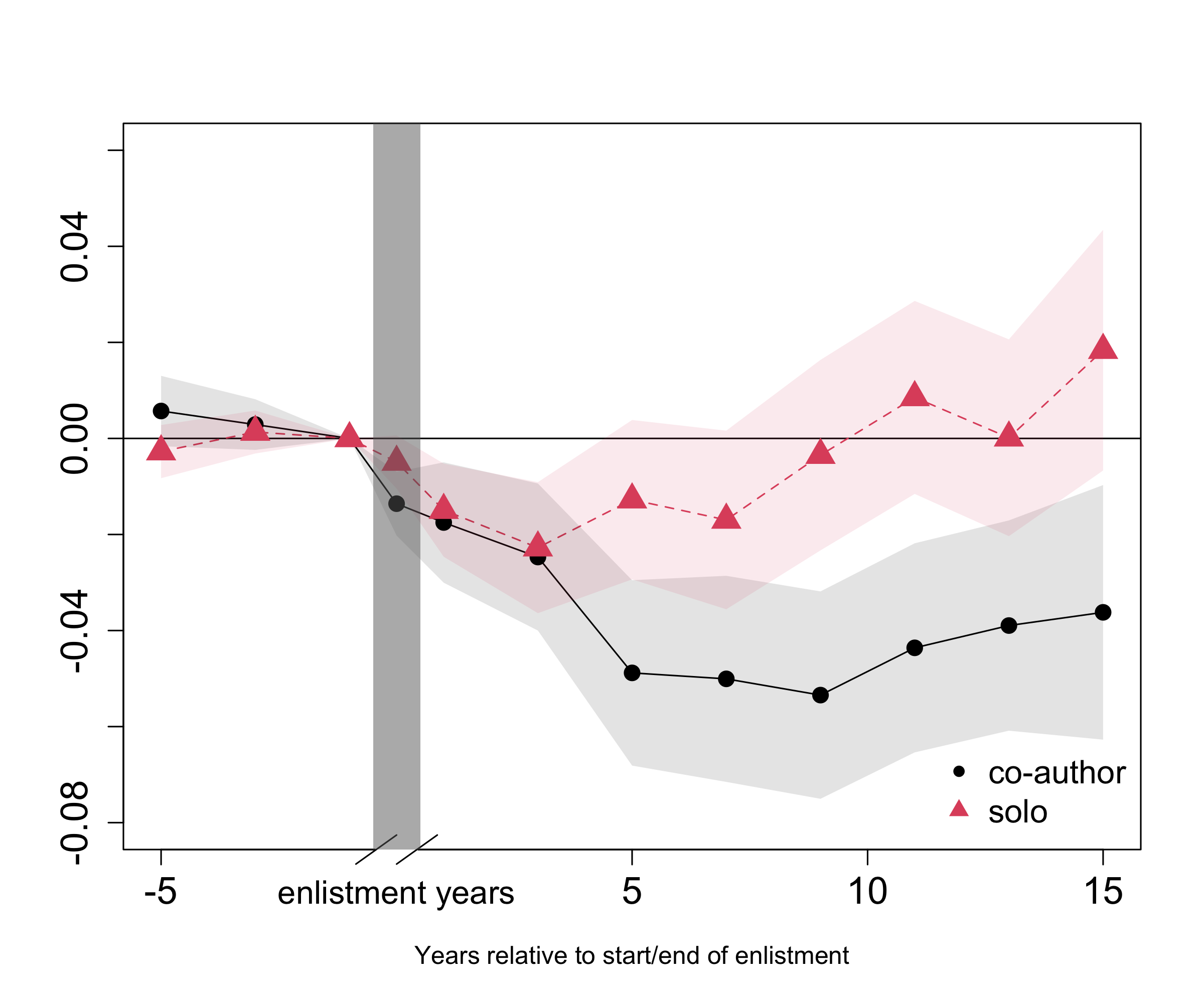

After exposure to combat, co-authorships never recover.

Shell Shock: How Exposure to Combat Affected US Scientists after WWII

How does exposure to combat affect productivity? We investigate this question for scientists who fought in WWII. To measure exposure to combat, we apply natural language processing to match 84,556 scientists with 9 million archival records of enlistment and hospitalizations. Event studies compare changes in publishing after service for enlisted with non-enlisted draft-eligible scientists of similar age, education, occupation, and marital status. We find that enlisted scientists are less likely to publish for 10 years after the end of their military service. This decline is not driven by time away from research: scientists who had served in combat suffer a large and persistent additional decline in productivity relative to other enlisted scientists. Instead, the decline appears to be driven by changes in co-authoring: Solo-authored publications recover to pre-enlistment levels after exposure to combat, while co-authoring stays low. Scientists who have experienced combat also stop publishing at an earlier age, and their publications decline in their late 30s, before those of other scientists. Using hospital admission to identify scientists with combat wounds, we show that declining productivity after combat cannot be explained by physical wounds.

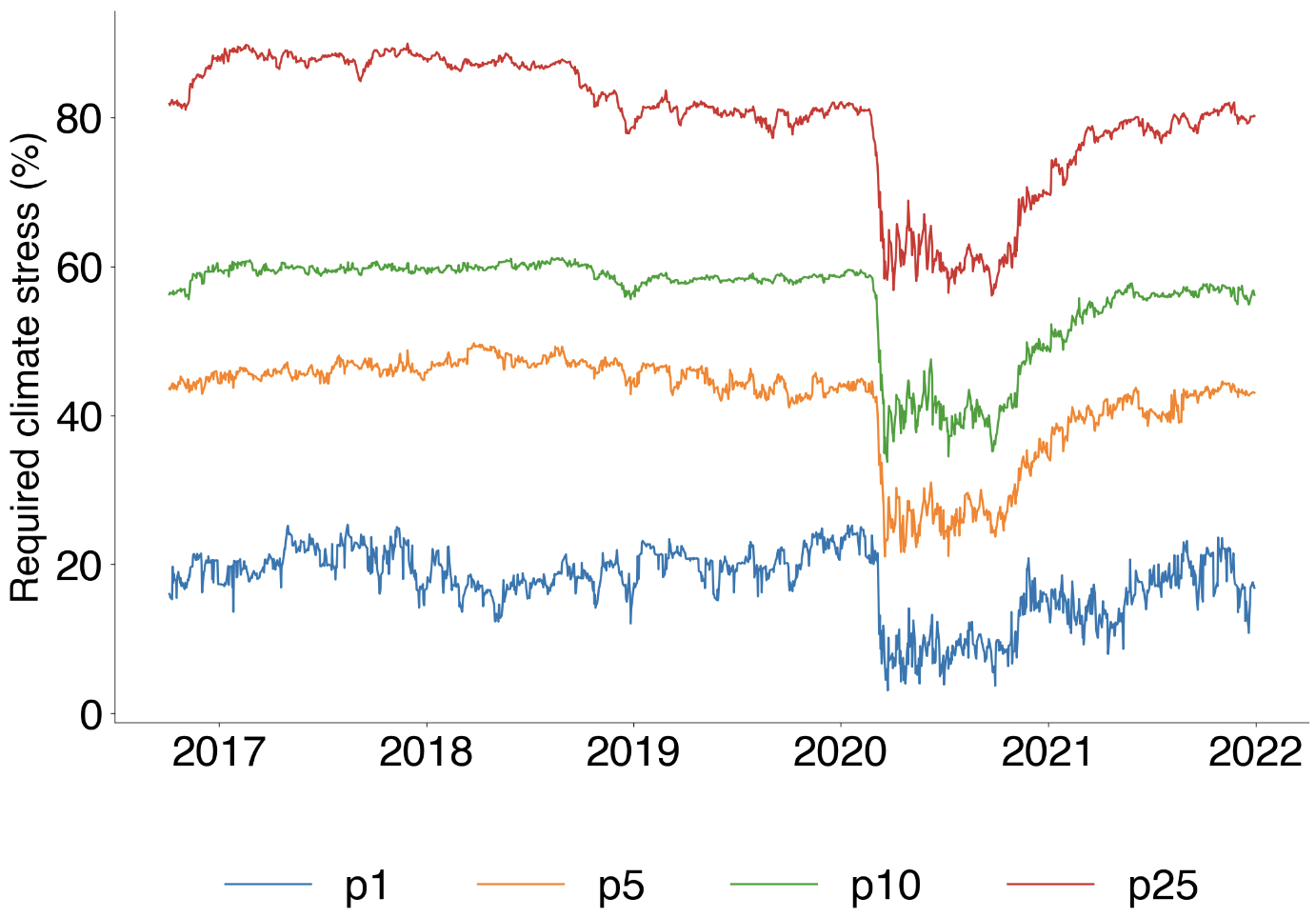

A brown industry shock 10x as viral as the US re-entry to the Paris Agreement can de-stabilize the bottom 1% of financial institutions.

Virality to Vulnerability: Reverse Stress Testing of Belief Shocks

Social media has become a significant channel for shaping economic agents' beliefs, with such shifts influencing asset prices. In the context of climate stress testing, we find that climate events going viral on Twitter have longer-lasting effects on stock returns than similar events covered by traditional news outlets without achieving virality. This indicates that financial intermediaries holding affected assets may be vulnerable to the rapid shifts in beliefs observed on social media. To quantify this risk, we develop a reverse stress testing framework. First, we construct a climate virality index based on retweets of influential accounts, interpreting innovations in the index as shocks to climate change beliefs. Second, we design a hedging portfolio to mitigate the risk of abrupt belief shifts and estimate financial institutions' sensitivities to its returns. Finally, we quantify the magnitude of climate-related shocks required to destabilize financial institutions. We further demonstrate the flexibility of our framework by applying it to other dimensions of risk, such as geopolitical risk. Given the challenges in assessing scenario probabilities in traditional stress tests, our reverse stress testing approach provides a valuable tool for identifying and preparing for systemic risks.